Conclusion: Despite its toxicity, the overwhelming efficacy advantage of the Keytruda + Lenvima regimen in first-line (1L) treatment of advanced clear cell renal cell carcinoma (ccRCC) puts it in a position to lead the market in this indication. Tolerability concerns will limit its share.

Winning an FDA approval in August 2021, the combination of Lenvima (lenvatinib, Merck + Eisai) and Keytruda (pembrolizumab, Merck) is the most recently approved TKI/IO therapy with an NCCN category 1 recommendation for 1L treatment of advanced ccRCC. This is the third TKI/IO combination to secure an FDA approval and category 1 recommendation, with Inlyta (axitinib, Pfizer) + Keytruda being approved in April 2019, and Cabometyx (cabozantinib, Exelixis) + Opdivo (nivolumab, BMS) approved in January 2021. The approvals and category 1 recommendations of these regimens span all risk groups. These regimens have since bumped sunitinib (Sutent by Pfizer, which went generic in August 2021) from a category 1 recommendation to a category 2A recommendation. Our comparison of the category 1 TKI/IO regimens in this indication shows that although the Lenvima + Keytruda regimen may be more toxic than the others, this disadvantage is modest relative to its major improvement in efficacy. Our analysis is based on phase 3 clinical trial data (CLEAR, CheckMate 9ER, and KEYNOTE-426).

Historically, new regimens with clinical innovation over 10% achieve strong patient share. Lenvima + Keytruda shows 13.4% clinical innovation over Inlyta + Keytruda, driven by improved efficacy.

Lenvima + Keytruda should excel commercially in patients who are able to tolerate it. Dose reductions and interruptions will help manage the toxicity of this regimen and expand its usage to patients who may not able to tolerate it otherwise.

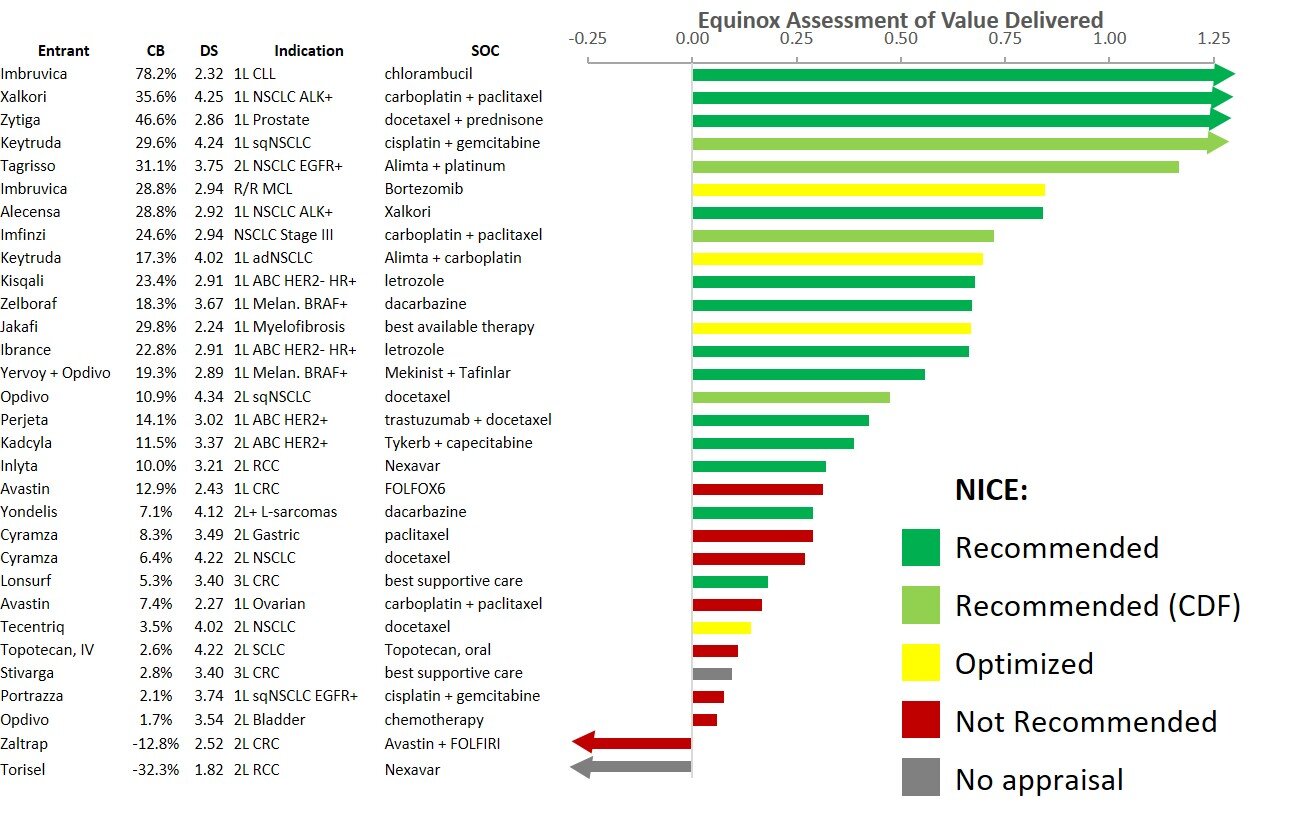

For the clinical benefit that Lenvima + Keytruda provides relative to Inlyta + Keytruda, its higher price is reasonable. Because of this, it falls within the “cloud” of drugs that have historically achieved good market access, and we predict that Lenvima + Keytruda will perform well commercially.

As a side note, Cabometyx + Opdivo is likely to capture share in this indication as a more tolerable alternative to Lenvima + Keytruda, with its efficacy improvement driving its 7.1% clinical innovation over Inlyta + Keytruda.