Sickle cell disease affects roughly 100,000 Americans and is more common among African American and non-Hispanic Black people [1]. About 20,000 suffer from recurrent vaso-occlusive crises (VOCs), making them ideal candidates for the novel gene therapies Casgevy (exagamglogene autotemcel, Vertex) and Lyfgenia (lovotibeglogene autotemcel, bluebird bio, rebranded as Genetix Biotherapeutics) [2]. Priced at $2.2 million and $3.1 million, respectively, these drugs are highly innovative and – we conclude – worth the high price tags if payers can figure out how to foot the bill.

Approved in December 2023, Casgevy is a CRISPR/CAS9-based therapy, the first of its kind. Its administration procedure is similar to that of a stem cell transplant and it is incredibly efficacious, with 93% of patients in the clinical trial remaining VOC-free 12 months after treatment [3]. Casgevy also boasts an approval in transfusion-dependent beta-thalassemia, a rare blood disorder that affects only 1,300-1,500 people in the US [4]. Lyfgenia is similarly efficacious and works via a lentiviral vector to insert a functional copy of the beta globin gene to increase the production of normal hemoglobin.

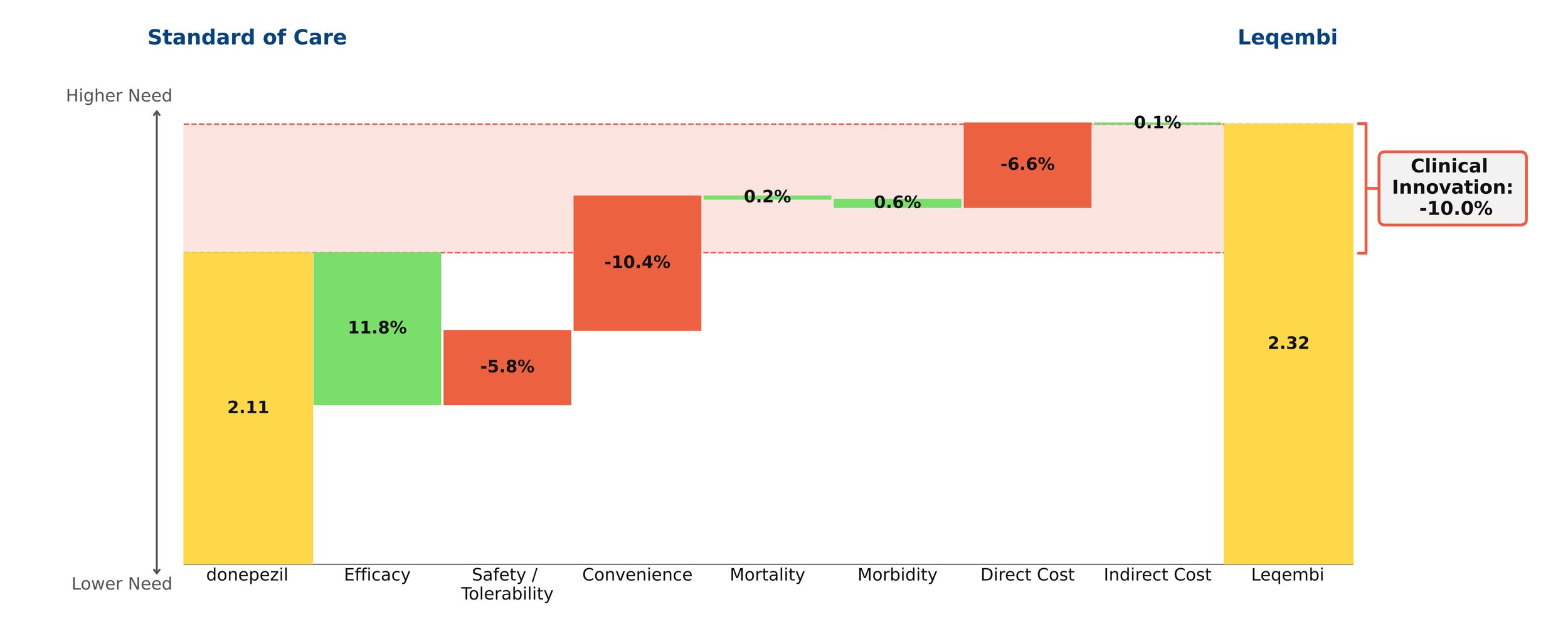

Both therapies demonstrate high clinical innovation when compared to the standard of care, hydroxyrurea, with a direct cost amortized over three years. Amortization is based off clinical data demonstrating that patients who achieve VOC-free status over 12 months remain VOC-free for approximately 3 years [5, 6]. This assessment may change as more long-term data becomes available. With the life expectancy of sickle cell disease patients being far shorter than for those without the disease, these therapies have the potential to substantially close that gap, with a University of Washington study finding a benefit of approximately 17 years of increased life expectancy from the gene therapies [7]. Our model captures a dramatic 85% reduction in mortality to align with this. These therapies are even more impressive when considering the high unmet need of sickle cell disease, in addition to the societal and indirect cost savings they may bring.

However, the issue of paying for these high-priced therapies looms large. An analysis conducted by the Institute for Clinical and Economic Review (ICER) in 2023 concluded that they are cost-effective at a price range of $1.5-$2 million [8]. At $2.2 million, Casgevy is pushing that limit, and at $3.1 million, Lyfgenia is well out of the range. With these steep price tags, it will be a challenge for payers to figure out how to pay for them, especially considering that a large percentage of the patient population is underserved and on Medicaid [9]. Currently, CMS has proposed an outcomes-based pricing scheme (CGT access model) that individual states can opt into. Only patients enrolled in Medicaid could benefit from the model, which began in early 2025.

This model has the potential to reduce the cost for states to bear, as CMS is the central negotiator for all states and will be providing federal funding for the treatment. States can choose which gene therapies to cover [10]. Based on our analysis, we believe that covering Casgevy is more reasonable than Lyfgenia, but having more options could be beneficial for patients, even with Lyfgenia’s black box warning for hematologic malignancy that demands long-term monitoring indefinitely [11]. Manufacturers will be encouraged to provide rebates and reimburse accordingly in cases where clinical performance falls short. The initiative will also be collecting data over eleven years, with an outcomes-based agreement term of one to six performance years, which will provide further insight into navigating these expensive gene therapies [12]. The model does not include private insurance plans for those not enrolled in Medicaid. Patients on private insurance plans may face additional requirements for treatment, such as meeting a specific threshold of number of VOCs per year, and a baseline level of decent health.

Gene therapies have limits; they are not foolproof cures. Not all cells can uptake the edits, there may be off-target gene editing effects, they are not effective for every patient, and immune system responses may limit efficacy and compromise health [13]. The treatment journey is also time-consuming, with the Casgevy website stating that it can take up to one year [14]. Since long-term data are not currently available, we must learn as we go, but it is clear that Casgevy and Lyfgenia are an important milestone in the cell and gene therapy space.