Paroxysmal Nocturnal Hemoglobinuria (PNH) is rare blood disorder estimated to have a global prevalence of 12 to 13 per 1,000,000 people [1]. This condition can potentially lead to kidney disease, hemolytic anemia, and even life-threatening blood clots [2]. Until the C5-inhibitor Soliris (Alexion, eculizumab) was approved in 2007, there were no approved therapies for PNH [3].

While Soliris, along with Alexion’s other C5 inhibitor, Ultomiris (ravulizumab, which was approved for PNH in 2018 [4]), are still considered standards of care, the market has grown with the approvals of Empaveli (Apellis, pegcetacoplan), Fabhalta (Novartis, iptacopan), and PiaSky (Roche, crovalimab). Using Equinox drivers charts can help us understand how these newer entries compare to Alexion’s drugs.

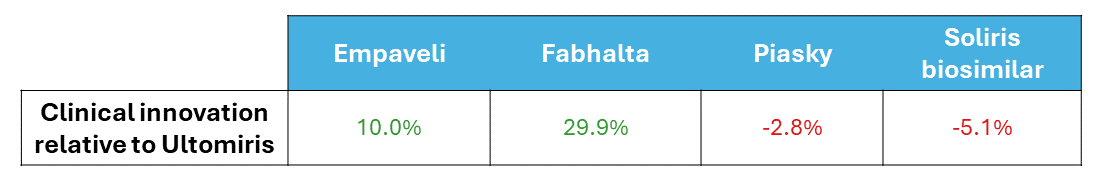

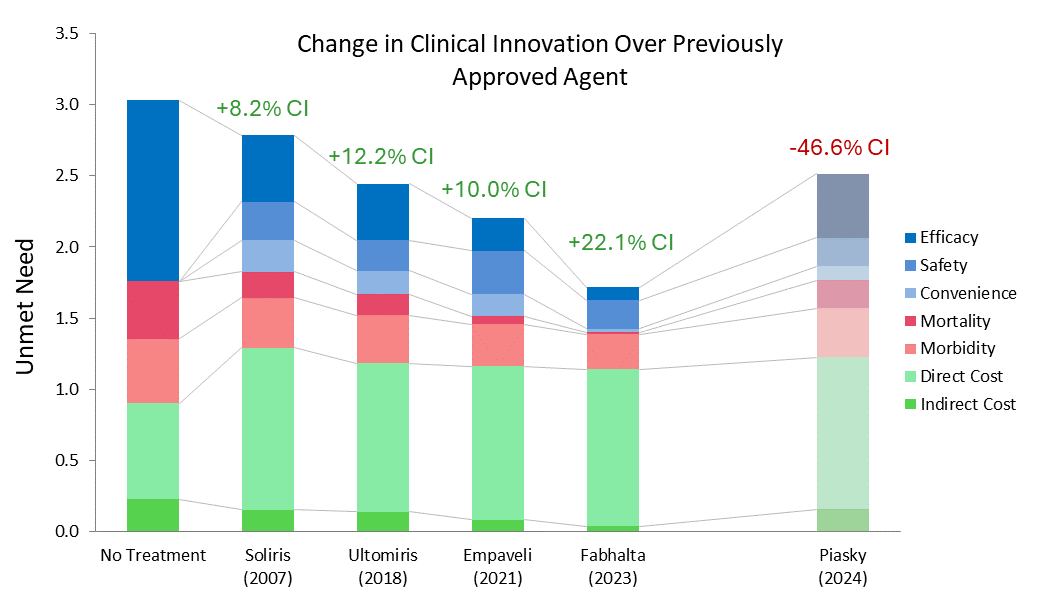

Equinox characterizes a drug’s improvement relative to a previous standard of care or another drug with a Clinical Innovation (CI) score, which quantifies how much the new agent lowers unmet need in the indication. For frame of reference, products with >2% CI score are typically commercially viable, products with >5% CI score are commercially successful (top 3-4 in market), and products with >10% CI score are market dominators.

Fabhalta has a whopping CI score of 29.9% when compared to Ultomiris. Though Fabhalta being the first oral agent in this indication is an improvement on its own, its substantial efficacy benefits flow through to improve morbidity and mortality across the board. Although Fabhalta has the highest WAC ((Wholesale Acquisition Cost) among the PNH drugs in this analysis, this is offset by reductions in hospitalization and associated medical costs.

While Empaveli improves upon Ultomiris’s efficacy, it does not do so to the same extent Fabhalta does. Additionally, while Empaveli can be administered at home, the frequency of administration is increased, offsetting some of its convenience benefit. In most cases, a 10.0% CI score would be expected to be a market dominator, but because it still falls far short of Fabhalta, this would be an exception.

Finally, although Piasky is more convenient than Ultomiris, this is not enough to overcome its marginally reduced efficacy at the current WAC. We do not expect it to be competitive in this market, especially against newer drugs that reduce unmet need further, such as Fabhalta and Empaveli.

Soliris 2007 reflects Soliris WAC at launch; all costs inflated to 2025 USD.

Equinox also acknowledges the approval of Voydeya in this indication, though it was not included in this analysis due to it being approved as an add-on therapy for Soliris or Ultomiris, not a monotherapy.