Where the Uncertainty Lies

Assets in mid to late-stage development are seldom immune to uncertainty surrounding their efficacy and safety profiles as well as that of their competitors. When considering these variables along with launch timing and the potential for reimbursement friction, traditional techniques such as conjoint analysis are rendered ineffective. Such circumstances require far more objective, dynamic, and future-proofed approaches.

A Data-Driven Approach

Using our unmet need framework, Equinox Group consistently quantifies the clinical improvement offered by a drug using a metric that we call Clinical Innovation. This measure has proven to be highly predictive of peak-year patient share and has been the basis of our analyses for over 30 years.

By objectively quantifying the Clinical Innovation of a new drug and all of its relevant competitors, we enable our clients to prepare for all possible scenarios that they will face during development and to seamlessly toggle between them.

Wargaming with Multiple TPPs

By quantifying the uncertainty in a given indication, we can understand its implications with remarkable accuracy.

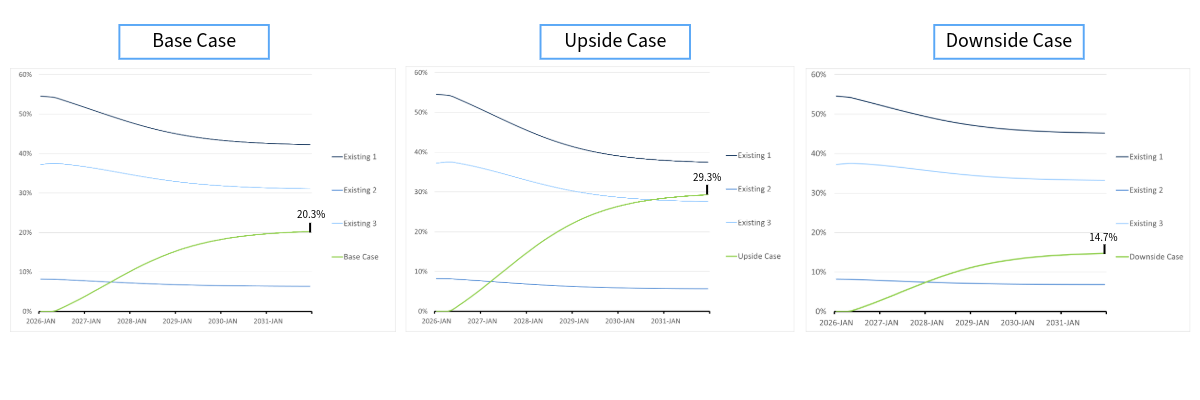

Consider, for example, a chronic disease with three agents currently in the market. Working alongside the client, we come up with a base case, an upside case, and a downside case for their new drug, taking into account efficacy, safety, side effects, dosing, administration, price, and launch timing. Under the base case, the new drug achieves 20.3% share of drug-treated patients by the end of 2031. Under the upside and downside cases, it achieves 29.3% and 14.7% respectively. As a result, in a world where no competitors are launching in the coming years, we have bounded the share potential between 14.7% and 29.3%. By assigning probabilities to each of the three scenarios, a simple weighted average will yield the expected share by the end of 2031 under the assumed conditions. In this example the modeled probabilities of the base, upside, and downside cases are 71%, 21%, and 8%. This results in an expected value of 21.7% patient-share by 2031.

Figure 1: Launching without a threat

Introducing Competitors

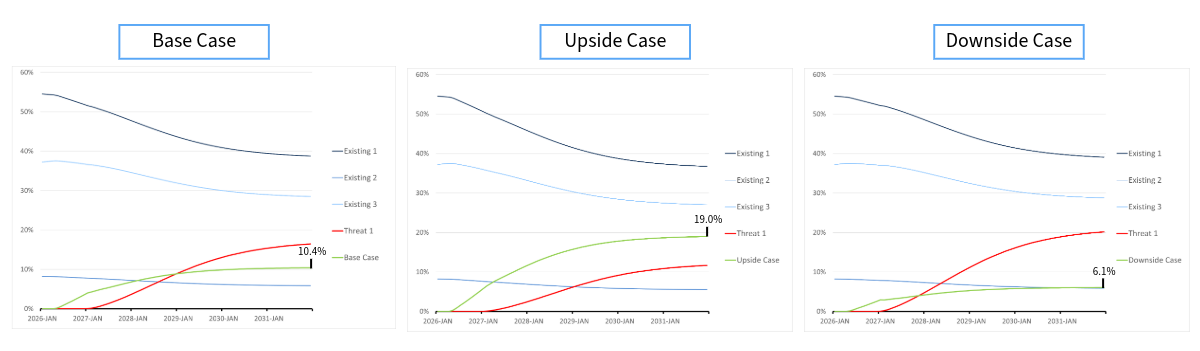

By studying the different scenarios in Figure 1, it is clear that the client agent has moderate potential. Now, consider a highly innovative competitor, which we call Threat 1. With Threat 1 launching one year later than the client agent, it will have considerable, yet diminished, impact on the terminal shares. Now, the client agent 10.4% patient-share in the base case and 19.0% and 6.1% in the upside and downside cases respectively.

Using the same probabilities of 71%, 21%, and 8%, we get an expected value of 11.9% patient-share by 2031. These probabilities can be informed by input of the client organization and approximated through Monte Carlo simulations, which are easily implemented into our framework when handling uncertainty around all relevant product attributes including launch timing.

Analyses like this can be made as complex as needed, allowing for up to 15 different drug profiles, characterizing the variety of potential attributes of your drug as well as all relevant competitors.

Figure 2: Launching with a threat

What About When the Data Changes?

Whether it be new clinical data pertaining to your agent or any of its competitors, the dynamic nature of these models allows client organizations to change the relevant inputs within a matter of minutes with no additional cost. That means no need for funding 50 additional interviews with leading physician’s, no need for creating new stimuli, no guesswork, and no time wasted in order to obtain new patient-share estimates.

Equinox Group has fine-tuned these methodologies and others over the past 30 years to help biopharmaceutical companies handle challenges in R&D. Our specialties range from disease-area strategy and market access to patient share forecasting and patient flow modeling.

To learn more about our process, click here to schedule a meeting with one of our practice leaders.