Conclusion: Brukinsa will have a hard time differentiating itself as the third BTK inhibitor to reach market in relapsed/refractory mantle cell lymphoma (R/R MCL).

Brukinsa, developed by the Chinese biotech Beigene, is the most recent BTK inhibitor to earn an indication in R/R MCL. Approved in November of 2019, Brukinsa follows Imbruvica and Calquence to market, with those two enjoying a 6- and 2-year head start, respectively.

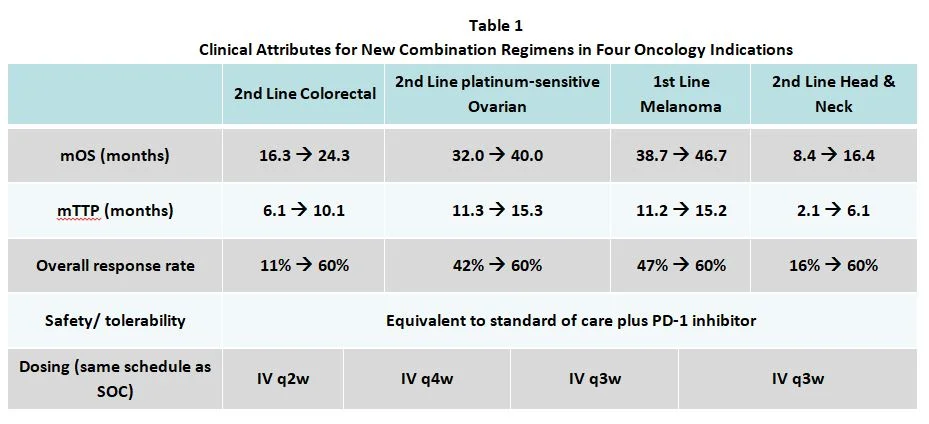

As shown in the clinical characteristics table above, Brukinsa has a marginally better response rate, but an inferior mPFS when compared to up-and-coming Calquence. Equinox’s Unmet Need framework allows us to numerically compare the net clinical advantage/disadvantages these agents offer in this indication.

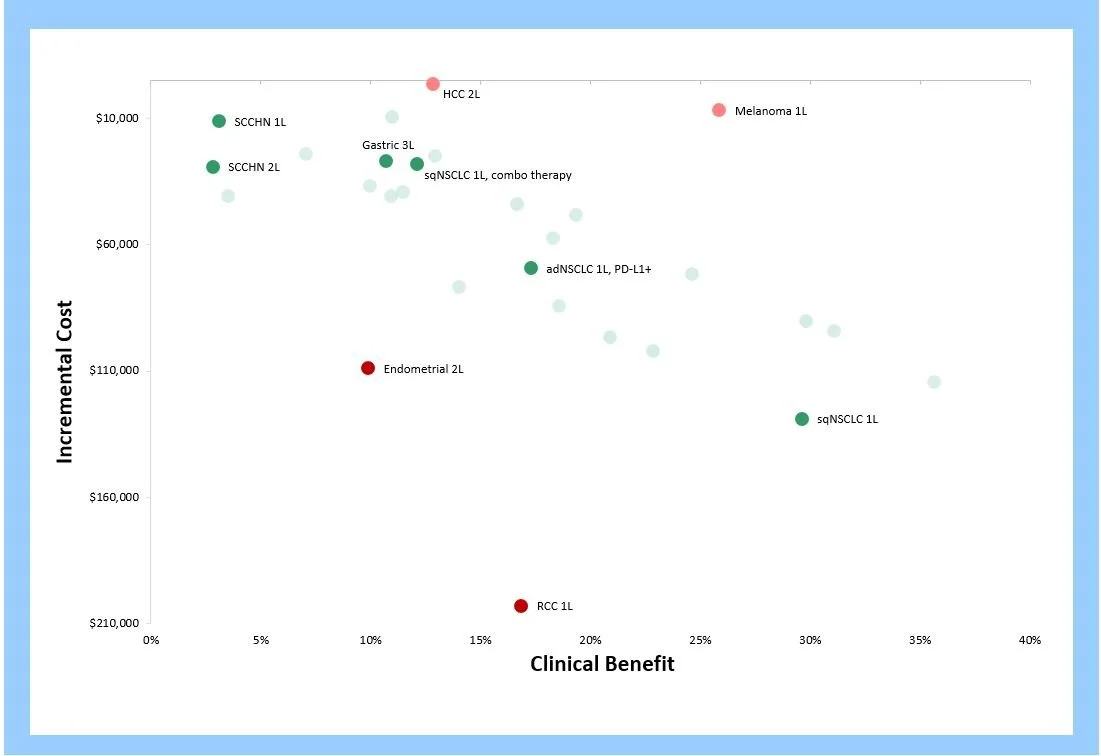

The figure below illustrates the level of remaining unmet medical need in R/R MCL with each therapeutic option. As shown, Imbruvica was a truly transformative medicine when it was approved in 2013— 22.6% better than Velcade (historically, 10% or more represents strong differentiation). Calquence offered a further 8% improvement over Imbruvica as measured in our framework (between 5% and 10% is considered medium improvement). Brukinsa, however, is 6.1% worse than Calquence. Keep in mind when viewing the graphic below that lower values represent improvement.

We expect Brukinsa to struggle to differentiate itself from the other two BTK inhibitors that beat it to market in this indication, and we believe its weak initial revenue figures are an early indicator of the trying path to success that lies ahead.