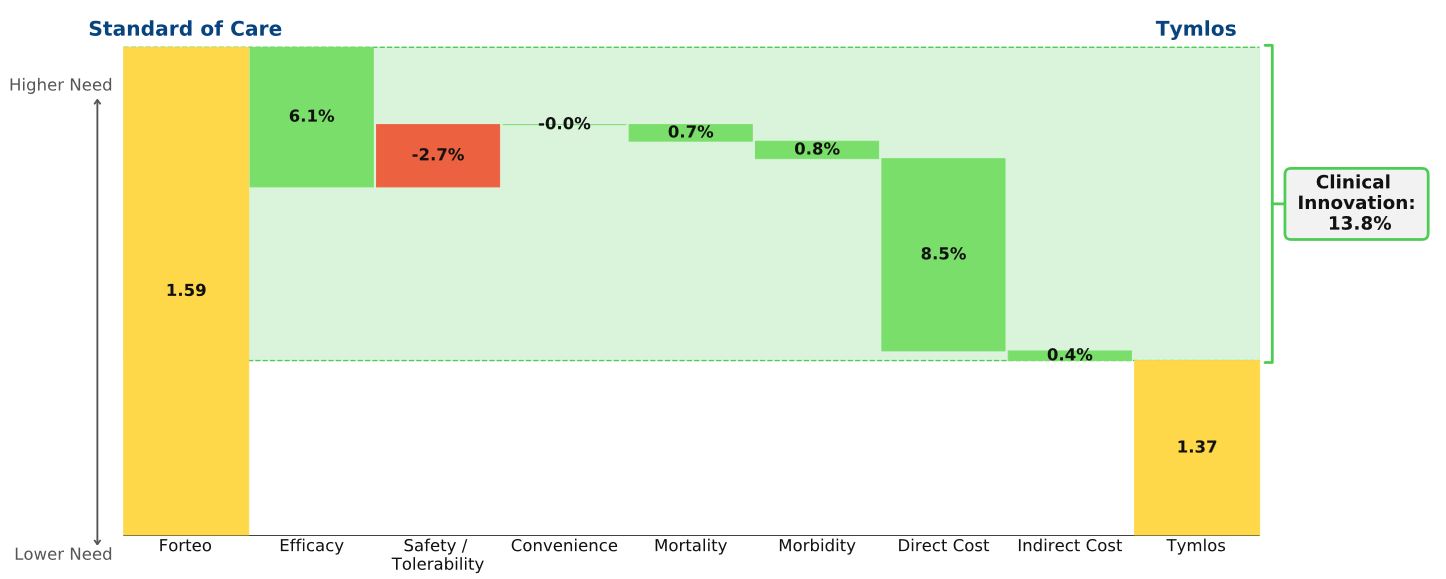

Conclusion: In postmenopausal osteoporosis patients at high risk of fracture, Tymlos offers improved efficacy at a much lower price than Forteo. We expect Tymlos to slowly but significantly cut into Forteo’s share.

Tymlos to Overtake Forteo in PTH-treated Market Segment

Direct competitors, Tymlos (abaloparatide, Radius) and Forteo (teriparatide, Lilly) are both anabolic agents, delivered subcutaneously, and indicated for postmenopausal women at high risk of fracture.* In a study comparing both agents to placebo (ACTIVE trial), Tymlos outperformed Forteo on almost every endpoint, including percent reduction in patients with vertebral and non-vertebral fractures and increased bone mineral density at various bone sites. At less than half the price of Forteo (WAC = $17,000 versus $40,000 /yr), Tymlos is well-positioned to cut deeply into Forteo’s market share. Since osteoporosis patients are unlikely to switch medications, we expect Tymlos will rely on capturing newly diagnosed patients. So far, Tymlos has been successful in this approach: Radius claims that Tymlos captured 40% of new anabolic patient starts in December 2018. The impact Tymlos will have on Forteo’s market share is already emerging. After years of constant growth, Forteo’s revenue decreased steadily throughout 2018.

Evolution of the Osteoporosis Market

The osteoporosis market continues to become stratified into lines of therapy. Payers will likely require all newly diagnosed patients (except those with very high fracture risk) to try a generic bisphosphonate first. Next, a patient will likely be directed towards Prolia (denosumab, Amgen) due to its moderate efficacy, better convenience, and lower cost compared with the anabolic agents (Prolia costs $2,400 per year and is administered subcutaneously every 6 months). Patients failing Prolia would then try Tymlos or Forteo.

On the Horizon

Amgen and UCB’s drug Evenity (romosozumab) will soon win approval and will directly compete with Tymlos and Forteo in the high-risk population. Evenity looks inferior to Tymlos in our model because its advantages in side effects and convenience don’t make up for its poorer efficacy. However, with its efficacy on par with Forteo and with better convenience, Evenity should further erode Forteo’s patient share and challenge Tymlos if priced similarly.

*Advanced age, frailty, glucocorticoid use, very low T scores, and increased fall risk are indicators of higher fracture risk in osteoporosis patients.